Chargeable Income Calculations RM Rate TaxRM 0 2500. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any.

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook

Calculations RM Rate TaxRM 0-2500.

. Malaysia Personal Income Tax Rates 2022. Based on your chargeable income for 2021 we can calculate how much tax you will be paying for last years assessment. Your 2021 Tax Bracket To See Whats Been Adjusted.

Total tax amount RM150. For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia. Do foreigners or expatriates who are working and earning income in Malaysia need to pay income tax.

1 day agoHe said while there is a need to create a level-playing field by imposing the same tax on local suppliers the government should have instead waived the sales tax for local suppliers for LVG below RM500 as many purchases in the bracket are made by the lower-income households. Income tax rates 2022 Malaysia. And the 30 rate applies to all income above 20000.

The 10 rate applies to income from 1 to 10000. Someone earning 5000 pays 500 and. Kindly take note that theres no update yet for the B40 income range for the year 2021.

For example in Taman Bintang there are five household incomes of RM5000 RM10000. Ali work under real estate company with RM3000 monthly salary. An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 for 5.

10 20 and 30. The current CIT rates are provided in the following table. On the First 10000 Next 10000.

Information on Malaysian Income Tax Rates. Resident individuals are eligible to claim tax rebates and tax reliefs. Chargeable income RM20000.

This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from RM1640 to RM585. B40 represents the Bottom 40 M40 represents the middle 40 whereas T20 represents the top 20 of Malaysian household income. Last reviewed - 13 June 2022.

Discover Helpful Information And Resources On Taxes From AARP. Chargeable income less than RM35000 can get a RM 400 tax rebate so Ali does not need to pay any tax amount to LHDN. Tax rates on chargeable income of resident individual taxpayers are calculated on a graduated scale with the lowest rate being 0 percent on the first RM5000 of chargeable income and the highest rate reaching 30 percent on chargeable income.

Under this system someone earning 10000 is taxed at 10 paying a total of 1000. Ad Compare Your 2022 Tax Bracket vs. Tax RM A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region.

Income Tax Rates and Thresholds Annual Tax Rate. In 2019 the average monthly income in Malaysia is RM7901. B40 M40 and T20 Malaysia refer to the household income classification in Malaysia.

Is the middle income number within a range of household incomes arranged from low to high. Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band. Malaysias Individual Income Tax Rate is 15.

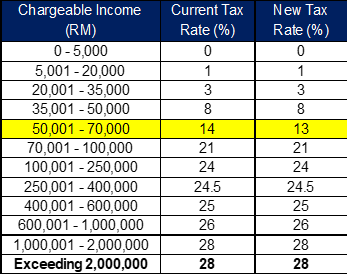

Here are the progressive income tax rates for Year of Assessment 2021. 13 rows Malaysia Residents Income Tax Tables in 2020. Total tax reliefs RM16000.

Employment income - Gross income from employment includes wages salary remuneration leave pay fees commissions bonuses gratuities perquisites or allowances in money or otherwise arising from employment. The 20 rate applies to income from 10001 to 20000. Personal Tax 2021 Calculation.

Chargeable income MYR CIT rate for year of assessment 20212022. Corporate - Taxes on corporate income. Your bracket depends on your taxable income.

There are seven federal tax brackets for the 2021 tax year. On the First 2500. Imagine that there are three tax brackets.

In Malaysia what is the rate of personal income taxation. 10 12 22 24 32 35 and 37. An individual employed in Malaysia is subject to tax on income arising from Malaysia regardless of where the employment contract is signed or the.

Any foreigner who has been working in Malaysia for more than 182 days considered as residents are eligible to be taxed under normal Malaysian income tax laws and rates just like Malaysian nationals. Annual income RM36000. Below are the Individual Personal income tax rates for the Year of Assessment 2021 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia.

Our Comprehensive Personal Income Tax E-filling Guide 2021 LHDN. On the First 2500. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing.

On the First 5000 Next 5000.

Singapore Raises Income Tax Rates For Top 5 Per Cent And Malaysia Anilnetto Com

Malaysia Budget 2021 Personal Income Tax Goodies

Cukai Pendapatan How To File Income Tax In Malaysia

Tax Guide For Expats In Malaysia Expatgo

Budget Highlight 2021 Taxletter 26 Anc Group

Malaysian Tax Issues For Expats Activpayroll

Individual Income Tax In Malaysia For Expatriates

7 Tips To File Malaysian Income Tax For Beginners

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Income Tax Rate Comparison Between Malaysian Singaporean R Malaysia

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook

Malaysian Bonus Tax Calculations Mypf My

How To Calculate Foreigner S Income Tax In China China Admissions

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News